Key Takeaways:

- Why is travel nursing in high demand in 2025?

- Which specialties and settings most rely on travel nurses?

- What are the pay and regional trends?

- How is the travel nursing market changing?

- What challenges must healthcare leaders face?

Why Travel Nursing in 2025 is Essential

Older patients are lining up and nurses are running out, healthcare in the US is definitely at a breaking point. By 2025, federal projections estimate a shortage of roughly 80,000 FTE RNs. Industry analyses put the cumulative deficit closer to 296,000 nurses nationally. In a market with scarce talent, travel nursing steps in to assist. Travel nurses are registered nurses who take short-term assignments (often ~13 weeks) at hospitals or clinics facing staff gaps.

Already about 1.75 million nurses (RNs+LPNs) work as travelers (over 1/3rd of the whole U.S. nurses), highlighting how embedded they are in staffing solutions. Facilities in fast-growing regions (e.g. California, Texas, Florida) in particular rely on travel RNs to cover surges. In short, as one industry source puts it, travel nurses have become the “silver bullet” for filling acute staffing holes.

- Demographic and Seasonal Drivers: Aging Baby Boomers and rising chronic illness mean more patients, while many current nurses retire. Seasonal spikes (flu season, COVID variants) also test staffing. Travel nurses allow hospitals to flex up quickly without long hiring processes.

- Workforce Trends: Although some data suggests the overall RN supply briefly rebounded, long-term projections still show shortages. The BLS forecasts only a 9% increase in RNs by 2030, not enough to meet surging demand. Travel nursing in 2025 addresses immediate gaps while longer-term solutions (new grads, retention strategies) catch up.

Travel Nursing in 2025: Specialties & Sectors

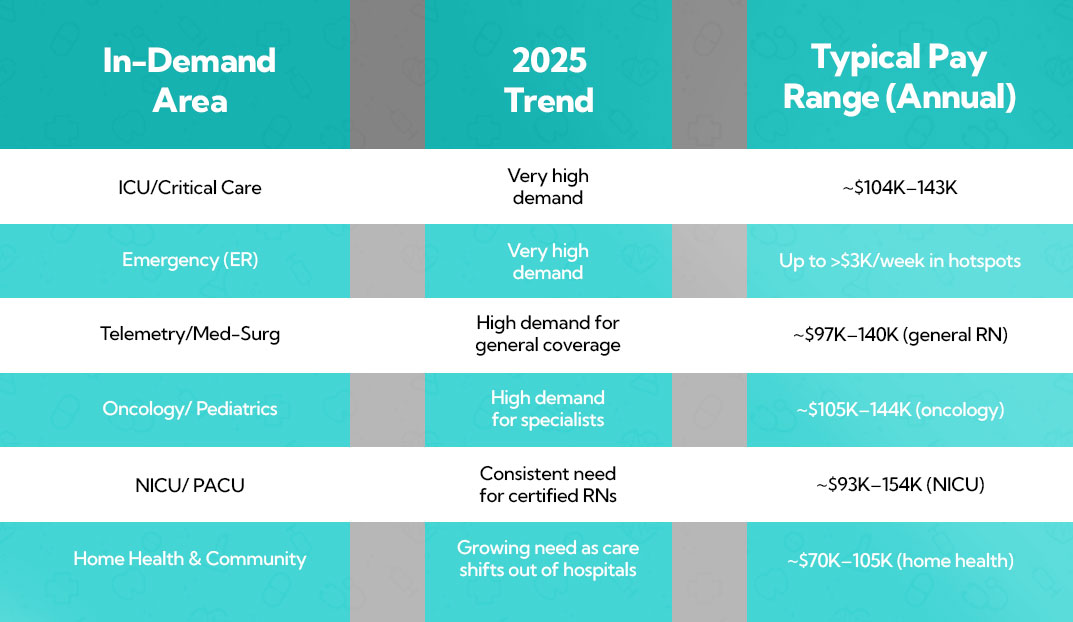

Certain clinical areas drive most travel nurse placements:

- ICU and Critical Care: These areas always need more staff because they need people with a lot of skills. When the number of patients at a hospital goes up, they need ICU nurses to keep everyone safe. ICU care is very specialized, so hospitals often pay extra (up to $3000/week in top markets) for travelers.

- Emergency Department (ER): Fast-paced ERs face unpredictable census surges. Travel ER nurses help out regular staff during emergencies and add extra capacity. It is often said that ER is a "hard-to-fill" specialty area.

- Telemetry/Medical-Surgical Floors: Travel RNs are often hired by general med-surg and telemetry units to help with hiring changes. These nurses make about $90,000 to $140,000 a year, which is a little less than ICU/ER tourists.

- Oncology, Pediatrics, NICU/PICU: Hospitals that hire travel nurses for these areas want nurses who are qualified and experts. For instance, travel nurses who work in the NICU and PACU make the most (NICU $93K–$154K/yr). Oncology and infant areas often have staff burnout, so travel RNs are often called in to help out.

- Operating Room and Labor/Delivery: Procedural areas like OR and L&D also use travel nurses to cover breaks and times when demand is high, in times of vacations or holidays. Travel nursing in 2025 needs certifications like CNOR for OR roles to arrive fully qualified.

- Home Health and Rural Settings: Travel nursing in 2025 is expanding into home health services, with them taking on more short-term home care assignments outside of hospitals. This is especially true in rural areas where there are constant gaps of RNs. This is a new trend that is growing as more care goes into the community setting.

Heading into a busy OR or L&D season?Take a breather and let us handle the stress.

Dependable staff is always essential to keep surgeries and deliveries running smoothly. Trice Healthcare works with certified travel nurses who know the ins and outs of OR and L&D units. We can line up skilled professionals at any moment so you can focus on delivering great patient care without worrying about staffing.

Challenges for Healthcare Organizations

While travel nurses provide essential flexibility, hospital leaders must navigate several challenges:

- High Labor Costs: Premium pay and stipends make travelers expensive. An AHA report found that in early 2022 some hospitals were spending over 38% (and in extreme cases 50%) of total nursing labor costs on travel nurses. Even though rates are cooler in 2025, travel contracts still far exceed typical staff RN pay. Managing budgets means deciding when a travel RN is justified versus hiring new staff or using per-diem RNs.

- Staffing Equity and Morale: Pay disparities can hurt team cohesion. It’s well documented that travel RNs often earn roughly double the weekly pay of staff RNs for the same shifts. This “double pay” has driven permanent staff to leave for travel roles, exacerbating shortages. Hospitals must handle morale carefully, possibly by adjusting internal raises, bonuses, or offering their own per-diem rates.

- Regulatory Constraints: Many states now regulate travel nursing. In 2021–2024, at least 14 states passed laws requiring travel staffing agencies to be licensed and capping agency fees or pay rates. These laws aim to prevent price-gouging but add compliance burdens. Hospitals working with agencies must ensure contracts meet state rules. There are also federal tax rules for stipends that complicate traveler compensation.

- Continuity of Care: Relying heavily on rotating staff can disrupt continuity. Travel nursing in 2025 needs orientation and time to learn each unit’s protocols. Some argue that too many travelers can actually lower overall team stability. This is why many facilities balance travel RNs with programs to grow their own local staff and internal float pools.

- Market Volatility: A study found that spending on travel nurses dropped by 37% from 2023 to 2024. Bookings may still be slow in early 2025, so the first half of the year is a good time to be careful. Hospitals should plan ahead for needs (like when the flu is spreading) and partner with staffing agencies to get patients faster. The market is settling by mid-2025, which is a good sign. As the year goes on, decision-makers should be able to make more accurate predictions.

FAQ (People Also Ask)

1. What’s causing the RN shortage in 2025?

There's a growing need for care among older patients, with many nurses retiring and an increase in chronic illnesses. This is creating a demand that’s outpacing the number of new graduates stepping into those roles. Federal projections are saying there could be a gap of about 78,600 full-time equivalent registered nurses in 2025. On the other hand, industry analyses are pointing to a much larger deficit of around 295,800 nurses across the country.

2. What is travel nursing and how does it help?

Travel nurses are registered nurses who take on short-term assignments, usually about 13 weeks, at hospitals or clinics that need extra help with staffing. They assist facilities in adapting quickly during busy times or seasonal increases without needing to make permanent hires, ensuring that patient care remains consistent.

3. How widespread is travel nursing in the U.S.?

About 1.73 million nurses (RNs and LPNs) work as travelers(over 1/3rd of the entire U.S. nursing workforce). This underscores how embedded travel nursing is in staffing strategies, especially in fast-growing regions like California, Texas, and Florida where demand surges are common.

4. Why do hospitals in fast-growing states rely on travel RNs?

Facilities in regions like California, Texas, and Florida often face patient surges from population growth and seasonal spikes. Travel RNs let these hospitals increase capacity quickly without lengthy hiring, keeping patient care uninterrupted during peak demand.

5. Can travel nursing solve long-term RN shortages?

Travel nursing fills in the gaps in staffing while long-term answers, like hiring new grads and keeping current ones, become apparent. Projections show only a 9% RN supply increase by 2030, insufficient for demand. Travel RNs act as a “silver bullet” until longer-term fixes take hold.

By Shourya Mehta

By Shourya Mehta